Brands wishing to tap into the Japanese market should consider these key consumer factors in their strategy: an expectation of outstanding service, cultural identity and an aging population.

Consumer trends are patterns, behaviors or habits that a group of people have with regards to the consumption of goods or services. Trends include information about who, what, when, where and why consumers use certain goods and services. It is imperative to understand and collect such information in order to address each consumer segment in a comprehensive manner.

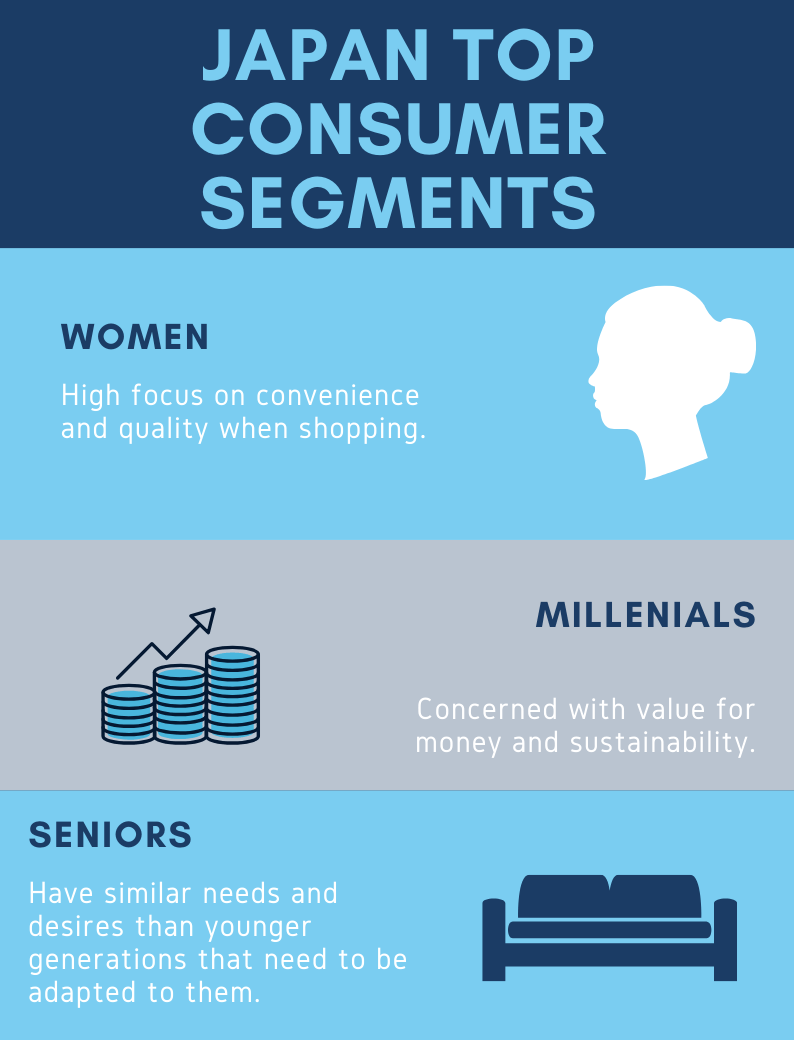

Although steadily declining, Japan’s population stands at 127 million people, with the majority urban (94% in 2019) and highly educated. We’ve zoomed in on today’s key Japanese consumer segments – Women, Millennials and Seniors- to help brands adapt their marketing strategies for each one of these.

1. Women

Prime Minister Shinzo Abe’s “Women Shine” message back in 2012 illustrates the country’s shifting demographics and work dynamics.

Japan’s decreasing and aging population is leading to a shortage of workers to support the economy, which in turn has created a vacuum for women to step in. Indeed, the government estimates that by 2050, 40% of all Japanese will be over 65. This shortage and subsequent promotion of these ‘womenomics’ led to an increase in women entering or reentering (after childbirth) the workforce.

In fact, over the last decade, 1.9 million women entered the workforce, while the number of men exiting the workforce has gone up. Dual incomes in households have become more common while women continue to manage household purchases. While men still hold 87% of managerial positions (according to a 2017 government survey) in Japan, there is much room for progress. As the recent #KuToo movement of women taking a stand against high heels in the workplace has shown, this societal shift has nonetheless required brands to rethink their business models when it comes to products and marketing messages to tap into growing household purchasing power and cater to female consumers.

Studies have shown that Japanese women focus on quality and convenience when shopping. Ordering online for home deliveries or for pick-up at nearby stores has thus become more common thanks to widespread internet access, particularly via smartphones. Indeed, in 2019, 91% of the population browsed the internet on a daily basis and 65% of population access the internet directly from their phones (Source: Statista).

Key considerations for this customer segment:

- Content marketing needs to be focused on problem solving.

- Product needs to be practical. It’s all about convenience.

- Purchase needs to be easy to make and to collect.

2.Millenials

Though this sub-30s segment only accounts for less than a third of the population, millennials’ status as early adopters of new products means they have a more powerful impact than their segment size.

Having experienced the economic backdrop or infamous “Lost Decade” while growing up, millennials are optimistic yet focused on savings and responsible consumption. They prefer money- for- value items and actively research and compare before purchasing goods. A study by McKinsey found that trust and environmental considerations were also factors influencing buyers’ decisions thus making eco-responsible brands and thrift items appealing and successful.

Key considerations for this customer segment:

- Content marketing needs to emulate a lifestyle, be inspirational.

- Product needs to be innovative.

3.Seniors

Last but not least, the senior citizens, also known as the ‘silver market’ should be kept top of mind.

As they amount to almost a third of the population and have conserved good purchasing power, companies need to target this segment of the population by catering to their needs. Some companies have adapted their distribution modes by having products such as books or medicine available in popular convenience stores (Lawson’s, 7/11). Other brands’ strategies have relied on business tactics such as providing: a highly personalized in-store shopping experience, more customer-facing exposure, home visits to capture the market share of low mobility elders and bigger fonts on product labels. As an example, skincare brand Shiseido saw its sales rise when launching a line for “mature” skins with larger fonts. Although the elderly’s wants are usually not that far off from the preceding generation (make-up, working out, dating, dining) these have to be adapted to their needs.

Key considerations for this customer segment:

- Marketing mediums remain non digital (printed press, sales on the phone).

- One to one customer service needs to be outstanding and comprehensive.

Key Takeaways

For these three segments of the consumer market, while needs and wants can be quite similar, purchasing habits and expectations are quite different and thus need to be addressed accordingly. Likewise, although consumer patterns share commonalities across the Asia Pacific market, it would be a mistake for marketers to cater messages and products to these audiences in the same way. As a brand seeking to enter a new market in Asia, understanding the intricacies at play is fundamental to establishing brand image and reputation in order to capture the hearts of this public.

Interested in launching your brand in Asia Pacific? Are you already established but are finding it tricky to adapt your message to your audience? Get in touch with us and find out how we can support brand awareness, sales and customer satisfaction across the board.